The Bank of Uganda is projecting that economic activity in Uganda will drastically decline during the coming year, because of the shutdown measures introduced by government of Uganda and other countries to contain the COVID-19 pandemic.

BoU says that the hostile economic conditions could possibly persist until 2022, due to disruptions in global supply chains, declining domestic demand, reduction in people interactions and an anticipated depreciation of the Uganda shilling due to exodus of short-term investors, declining remittances and tourism receipts.

On the basis of this uncharacteristically bleak forecast, Bank of Uganda has fired off a number of economically-friendly missiles from its monetary policy arsenal aimed at boosting Uganda’s economy.

Perhaps amid the bleak forecast, there is good news that the health of the Bank of Uganda Governor Tumusiime Mutebile, who was last week hospitalized at Nakasero hospital is improving. According to BoU publicist Charity Mugumya, Mutebile returned home feeling better. He also signed off on the stimulus measures.

Among the measures is the offer by the Bank of Uganda to offer ‘exceptional liquidity or cash’ to commercial banks that are facing liquidity distress, for a period of up to one year.

The central bank has also offered to buy treasury bonds held by micro-finance deposit-taking institutions and credit institutions to ease their liquidity positions.

The central bank has also given banks what it termed as ‘exceptional permission’ to banks to restructure loans of corporate and individual customers. The central banks is also allowing banks the leeway to extend repayment periods by up to one year.

This measure will allow banks time to balance their books by facing less pressure from the central banks from writing off loans as bad loans due to delays by customers to complete repayment.

By the same stroke of the pen, the central bank has essentially asked borrowers to renegotiate loan repayment terms to fit into the bleak economic forecast.

The Central bank has however given commercial banks the discretion to assess borrowers on a case by case basis depending on the impact of COVID-19 on the business.

The move also comes amid pressures from different corners of Uganda’s society including president Museveni that suggested banks would be urged to restructure their loans.

During his update to the nation on the COVID-19 situation, President Museveni said the government would speak with commercial banks so they don’t seize people’s assets when their businesses have been shut for more than two weeks.

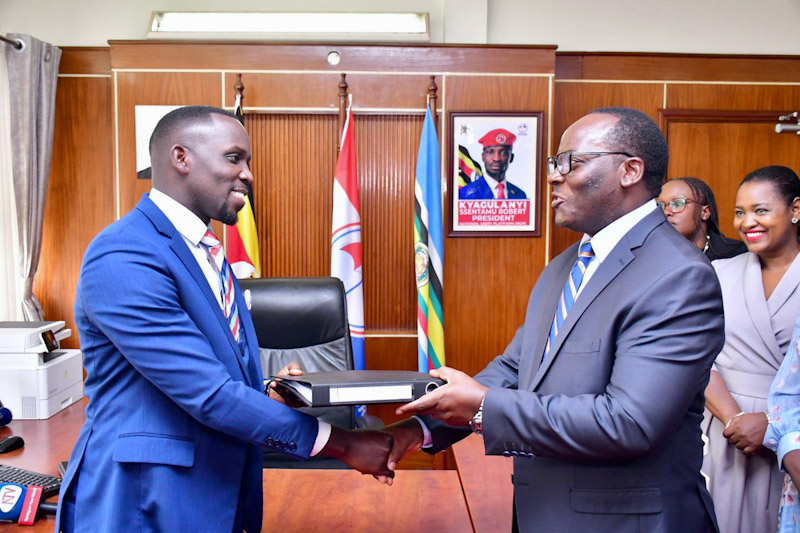

The Executive Director of the Uganda Bankers Association Wilbrod Owor has told a Ugandan daily that they are open to relaxing their positions on loan repayments but awaited guidance from the Central Bank.

Because borrowers are now facing the disadvantage of a hostile economic environment, it is incumbent upon them to approach the banks. They cannot expect banks to reach-out to them to revise the loan terms.

The Central Bank has largely delivered its part of the stimulus package and thereby setting the tone of what is to be expected of the central government.

This week, Finance Minister Matia Kasaija is expected to deliver the Fiscal stimulus package, a set of government interventions that are aimed at triggering increased spending on the part of the government to boost economic activity and employment.