A move by President Yoweri Museveni to block a total of 11 new loans amounting to US$ 1 billion from different government departments has been hailed by a number of civil society groups and individual economists as a step in the right direction of curbing Uganda’s spiralling rate indebtedness.

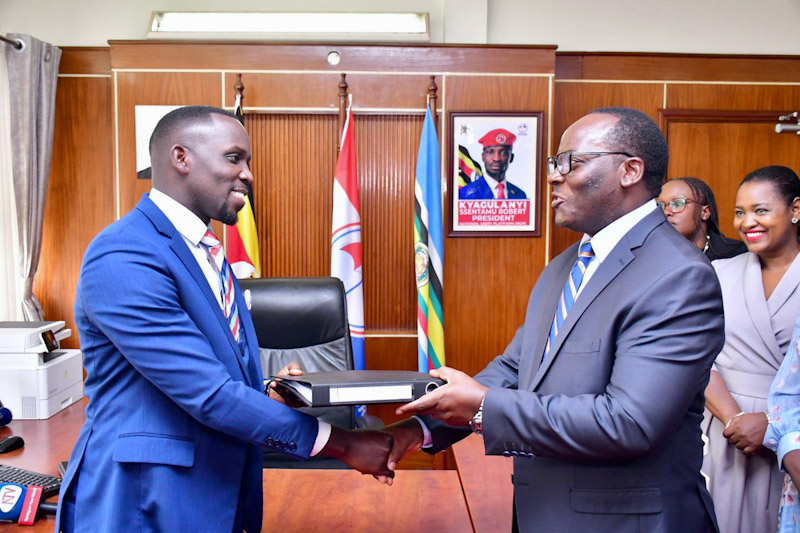

According to the President Museveni wrote to Speaker of Parliament Rebecca Kadaga, directing that Parliament should not approve any more loans without his personal approval.

“I would like you to address loans related to health, skills development and education. I believe that only infrastructure like hospitals, education should be the ones facilitated by loans otherwise the rest should be by the government of Uganda,” Kadaga quoted the President as saying.

CSBAG noted that the president had approved 16 loans out of the 27 loan applications.

The president’s directive has attracted praise from CSBAG and different economists as a step in the right direction. It comes a few weeks after CSBAG raised the red flag at the rate at which the country was contracting loans.

Ramathan Ggoobi, an economic analyst and lecturer at Makerere University Business School (MUBS) says the President is spot on.

“For the first time on this matter, I think the president is spot on. I wouldn’t mind who stopped this madness because we were bordering on crisis.”

Ggoobi also cautiously praised Museveni’s position on restricting loans on development projects particularly durable infrastructure as opposed to borrowing for recurrent expenditure, as has recently been indicated.

“If we’re to borrow, we need to borrow where returns are computable both in the short and long term. But even for infrastructure, it is high time we reviewed the rate at which we borrow for infrastructure projects after it’s been discovered we lack the capacity to execute all the projects at the same time. As already seen, we’ve mortgaged our oil by borrowing so much for infrastructure projects.”

Museveni usurping power of Parliament?

While the president’s directive may appear to be an encroachment on the independence of Parliament regarding its powers to approve or disapprove government spending and borrowing, Ggoobi says the President’s intervention was long overdue.

He says that Parliament, especially the Budget Committee, has failed to use its power to rein in government spending.

“Sometimes we blame dictators but its us who create them.” Ggoobi adds: “For a long time, that Budget Committee of Parliament has been lamenting about our debt getting out of control and yet, they have gone ahead to approve more and more loans including ones that come without Uganda government’s counterpart funding.

“I think that committee has been captured by the various managers of projects that seek to obtain loans.

Every step of debt approval, the project managers give out ‘cuts’ (bribes) to legislators to pass their requests. This is why we have partly come to the situation we are now in.

According to CSBAG, Uganda’s overall debt now stands at a mind-boggling US$20bn. US$6bn of which is domestic debt. The Pension monopoly NSSF accounts for $3bn of the total US$6bn domestic debt.

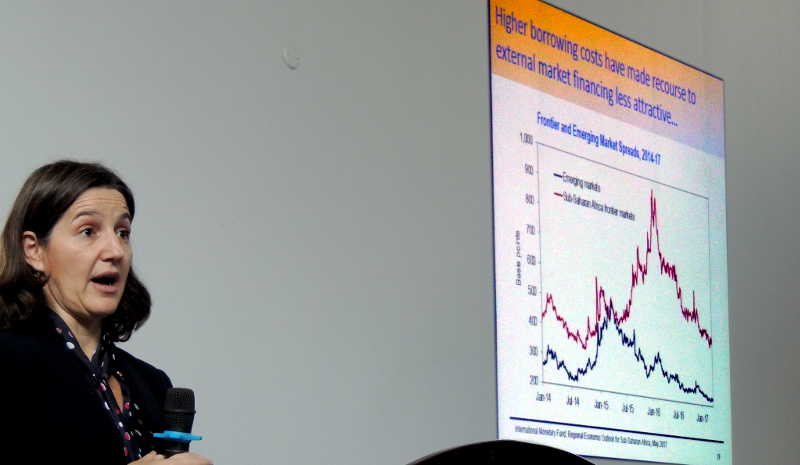

Although the International Monetary Fund (IMF) recently noted that Uganda’s debt level remains sustainable, below 50% of country’s GDP, many economists urged the Fund to re-evaluate its tools to measure debt sustainability.