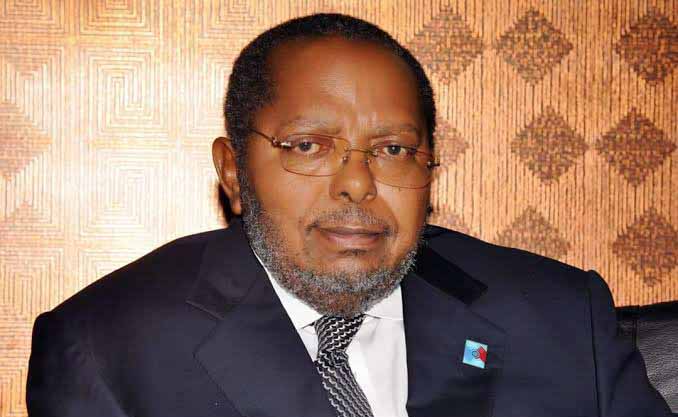

Finance Minister Matia Kasaija revealed during a news conference in Kampala that the government had decided to raise the Deposit Insurance Limit from UGX3million to UGX10m.n a measure seen aimed at boosting confidence in the banking system in Uganda, the government has raised the maximum insurable amount that depositors can recover in case of a bank failure.

Kasaija said the decision was taken to reflect the improved macro-economic changes in the banking sector recorded over the past 20 years. He added that the increase in the maximum deposit insurance is enough to cover up to 98% of depositors.

“We have increased DPF so that it can reflect the current macro-economic change, approximately 98% of all bank accounts will be fully insured however. This change will not result into increased premiums,” Kasaija added.

In July 1994, the government of the republic of Uganda under the financial institutions Act 2004 created an entity the “Deposit Protection Fund of Uganda (DPF),” The main purpose of the DPF is to give deposit insurance for depositors of all contributing financial institutions in case of total bank failure.

In this case contributing institutions are those licensed by the Central Bank and periodically contribute financially to the Deposit Protection Fund. Among these are commercial banks, credit institutions and microfinance deposit taking institutions regulated by the Central Bank.

The government may be by any means might have got alerted that there was possible bank closures that were knocking and there was need to prepare for the drought as a number of banks failed and closed between 1998-1999. Among these included International Credit Bank (ICB), Greenland Bank, Uganda Co-operative Bank and others.

However, the operationalization of the Deposit Protection Fund was only realized in 2017 with appointment and inauguration of a Board of Directors that constitutes seven members who represent various stakeholders for example the Government of Uganda, Bank Of Uganda, contributing institutions and the General public.

According to the Financial Institutions Act, 2004, depositors are to be paid within ninety days in case the contributing financial institution fails completely. The Minister added that for depositors with over UGX 10 million, they are to be paid after assets of the failed institution are sold off and the amount also depends on recoveries made.

Minister Kasaija’s comments came ahead of the first-ever International Conference on Deposit Insurance that is scheduled to take place from September 15 – 19, 2019 at Lake Victoria Serena and Golf Resort.

The main purpose of the conference is to share regional and global experiences on how effective deposit insurance schemes contribute to enhance public confidence in the financial sector and stability.

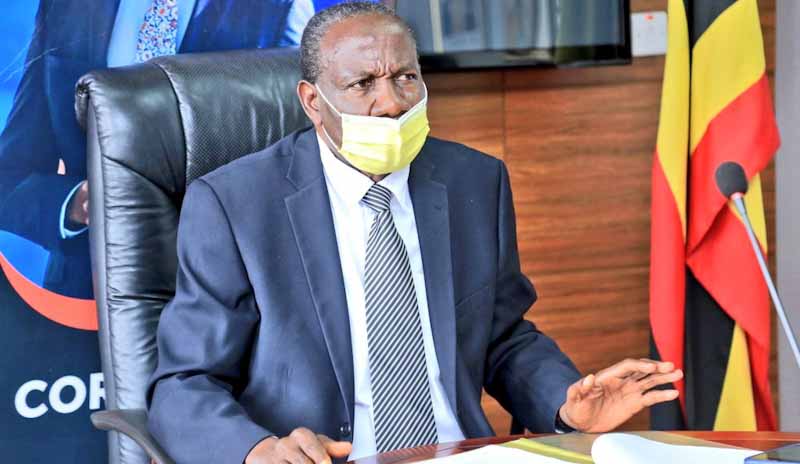

Julia Clare Olima Oyet, the Chief Executive Officer of the DPF observed that: “The fund currently has UGX650 billion in terms of absolute figures which is an increase of UGX70bn from UGX480 billion that was recorded in 2017.” She informed the media that the fund has made interest earnings worth UGX80 billion in the past years from its investment in treasury bills and bonds.